UPDATE x 7: A private investment firm is making a move on WWE following their hefty stock drop today. Seeking Alpha reports that Lemelson Capital, LLC announced that they had purchased a stake in the company and were calling on the Board of Directors to replace the current executive management team due to “a period of consistent losses, execution issues and material misstatements.”

The firm shorted the stock two months ago and reiterated that fair value of WWE’s common stock is between $8.25 and $11.88 with with the current executive management team in place. They said in the statement, “WWE has affirmed that even with one million subscribers for its WWE network, the company stands to lose between $45 million and $52 million in FY 2014, which validates the original short thesis. This follows what we believe to be material misrepresentations by the company about both the performance and operating profit model of its WWE network, which the company has wrongly labeled ‘a homerun'”

UPDATE x 6: WWE stock closed Friday at $11.33, down $8.66 (43.45%). The stock is now back to the levels it was at around mid-October of last year. The stock surged over the last few months on anticipation of WWE Network subscriber numbers and a big new TV deal, and now that those two did not deliver the numbers Wall Street and WWE (internally) expected, the stock has tumbled back down to what it was well before anticipation/speculation over those two things began. It should be noted that WWE still has a bit of room before it revisits its 52-week low, which was $8.96.

The TV deal can’t change now and pay-per-view revenue will likely continue to decrease every quarter, so WWE will be under even more pressure going forward to pump up revenue from WWE Network and increase the subscriber numbers.

WWE will hold an “emergency” conference call on Monday to address the company’s outlook. Vince McMahon, who lost roughly $340 million today due to the stock drop, will take part in that call. As noted earlier, the call on Monday shows you how worried WWE is about their stock plummeting as they are going to have Vince McMahon speak on it ASAP to try and calm down their investors. Basically, they are in “panic mode.

UPDATE x 5: As of 1:52PM ET, the WWE stock is trading at $11.28. This is down $8.65 from yesterday, representing a 43.4% drop.

UPDATE x 4: As of 12:59 PM ET, the WWE stock is trading at $11.32. This is down $8.61 from yesterday, representing a 43.2% drop.

UPDATE x 3: As of 11:50 AM ET, the WWE stock is trading at $11.36. That is down $8.57, and 42.9% overall.

UPDATE x 2: As of 10:50 AM ET, the WWE stock has rebounded a little bit. The stock is at is at $11.54, which is down a total of $8.40 (42.14%).

UPDATE: WWE stock closed yesterday at $19.93 and when the announcement was made about the new TV deal after the market closed, the stock dropped around $4 almost immediately. As of 9:50 AM ET, the stock is sitting at $10.75, which is down 46.01%. The company got around a 25% increase in TV rights fees, which on the surface sounds good, but the company continually stated that they were aiming to at least double the rights fees.

Following the launch of the Network and various reports of the TV deal and “a rumored sale of the company” the stock hit $30.

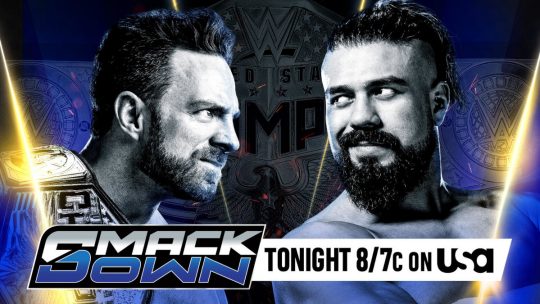

ORIGINAL: Earlier today, WWE and NBC/Universal announced a new multi-year deal for RAW and SmackDown to continue airing on USA Network and SyFy. The press release did not note the length of the contract, the terms of the deal or whether SmackDown will stay on Fridays or go live. It is worth mentioning that SmackDown is referred to as “Friday Night Smackdown” although that is the full name of the show on SyFy, so it doesn’t preclude the possibility of it going live.

The agreement also notes that Total Divas will continue to air on E!, which isn’t a surprise.

Vince McMahon said of the deal, “We are proud to continue our long-standing partnership with NBC/Universal given their premiere position in the marketplace and vast promotional platforms. We are excited about our future as we further the reach and popularity of our live, family-friendly entertainment programming 52 weeks a year.”

The press release was light on details and doesn’t answer whether RAW and SmackDown will get earlier debuts on the WWE Network, which was one of the last sticking points in negotiations.

More information will surely filter out, but as of now WWE is officially set to continue on their current networks for the next several years.

With that being said, WWE’s stock PLUNGED following the announcement of their deal with NBC/Universal. The stock closed at $19.93, which was up 3%, but was down $4.24 (down a HUGE 21%) in after-hours trading. The reason for this is the announcement that the new deal will be for $200 million, which is contrary to Vince McMahon’s statement on last year’s earnings call that they expected to at least double the value of their TV deal. Last year’s numbers were about $160 million.;

You can see the full financial details in a press release here. The company is using a bit of wordsmithing (which may be perfectly reasonable) in the release, noting that the $200 million number is “representing an increase of more than $90 million, that is nearly three times the increase achieved in the previous round of negotiations.”

The release also notes that there are about 77 million broadband homes between the US and certain international markets that “have an affinity” for WWE content and that based on the percentage of homes who have signed up for the WWE Network, they should have between 2.5 million and 3.8 million subscribers. They estimate that 1.3 million to 1.4 million subscribes will be required for the network to offset the “complete cannibalization of the company’s Pay-Per-View and SVOD businesses” as it would generate about $40 million, on par with the company’s Pay-Per-View and SVOD businesses in 2012.

100% DIRECT LINK (PHOTOS): Kelly Kelly & Maryse Get Frisky (SOOOOO HOOOOTTTTT!!!)!!

WWE NXT Notes: Street Fight Match & CM Punk as Special Guest Ref for NXT Title Set for 10/1 Show, Sexyy Red Appearance, Orton vs. Je’Von Evans, & NXT Tag Titles Matches Set for 10/8 Show, Zachary Wentz Reveals Wes Lee Injured Trey Miguel, 9/24 Card

WWE NXT Notes: Street Fight Match & CM Punk as Special Guest Ref for NXT Title Set for 10/1 Show, Sexyy Red Appearance, Orton vs. Je’Von Evans, & NXT Tag Titles Matches Set for 10/8 Show, Zachary Wentz Reveals Wes Lee Injured Trey Miguel, 9/24 Card TNA Impact Ratings – September 12, 2024 – Viewership Down, Key Demo Up from June 13 Show

TNA Impact Ratings – September 12, 2024 – Viewership Down, Key Demo Up from June 13 Show AEW: Swerve Strickland AEW Return Plans Update, AEW All In 2024 & All Out 2024 PPV Buys Update, Nigel McGuinness on Retirement from Wrestling in 2011 Not Due to Injuries

AEW: Swerve Strickland AEW Return Plans Update, AEW All In 2024 & All Out 2024 PPV Buys Update, Nigel McGuinness on Retirement from Wrestling in 2011 Not Due to Injuries