TKO Group held an investor’s meeting on Wednesday discussing the results from their fiscal 2024 third quarter report.

In regards to revenues, TKO generated $681.2 million in net revenues for the fiscal quarter with the split being $354.9 million from UFC and $326.3 million from WWE.

TKO generated $57.7 million in net income for the fiscal quarter. It was stated that this was up $22.7 million compared to last year’s fiscal quarter and the increases were partially offset by increases in operational expenses.

In regards to other financial areas, TKO’s Adjusted EBITDA for the fiscal quarter was $310 million. WWE’s media rights and content revenue for the fiscal quarter was $216.3 million. WWE’s live events revenue was $51.4 million, sponsorship revenue was $74 million, and consumer products revenue was $13.2 million for the fiscal quarter.

TKO Transaction Highlights

On September 12, 2023, Endeavor and WWE closed the transaction to combine UFC and WWE to form a new, publicly listed company, TKO Group Holdings, Inc. Reported results presented in this earnings release prior to September 12, 2023 reflect only UFC activity.

Third Quarter 2024 Financial Highlights

* Revenue of $681.2 million

* Net income of $57.7 million

* Adjusted EBITDA1 of $310.0 millionFull Year 2024 Guidance

* The Company revised its target for revenue to the upper end of the range of $2.670 billion to $2.745 billion

* The Company revised its target for Adjusted EBITDA to the upper end of the range of $1.220 billion to $1.240 billion

* The Company reaffirmed its target for Free Cash Flow Conversion2 in excess of 40%NEW YORK–(BUSINESS WIRE)– TKO Group Holdings, Inc. (“TKO” or the “Company”) (NYSE: TKO) today announced financial results for its third quarter ended September 30, 2024.

Ariel Emanuel, Executive Chair and CEO of TKO, said: “TKO’s solid third quarter results reflect continued strength across UFC and WWE, particularly in live events and brand partnerships. In light of this continued momentum, we now expect to deliver at the upper end of our full-year 2024 guidance range for both revenue and Adjusted EBITDA

“Additionally, two weeks ago we announced the authorization of a robust capital return program and an agreement to acquire industry-leading sports assets that will power our profile, give us greater scale, strengthen our position in the sports marketplace, and accelerate returns for shareholders. Just over a year since UFC and WWE came together to form TKO, our conviction in this business is as strong as ever.”

Third Quarter Consolidated Results

Revenue increased 52%, or $232.1 million, to $681.2 million. The increase reflected the increase of $274.7 million of revenue at WWE, to $326.3 million, partially offset by a decrease of $42.6 million at UFC, to $354.9 million.

Net Income was $57.7 million, an increase of $35.7 million from $22.0 million in the prior year period. The increase reflected the increase in revenue partially offset by an increase in operating expenses. The increase in operating expenses primarily reflected an increase in direct operating costs of $76.8 million, an increase in selling, general and administrative expenses of $46.4 million, and an increase in depreciation and amortization of $66.4 million.

Adjusted EBITDA1 increased 29%, or $70.3 million, to $310.0 million, due to an increase of $153.3 million of Adjusted EBITDA at WWE, partially offset by a decrease of $42.7 million at UFC and an increase of $40.3 million in corporate expenses.

Cash flows generated by operating activities were $236.6 million, an increase of $169.6 million from $67.0 million, primarily due to higher net income and the timing of working capital.

Free Cash Flow2 was $225.6 million, an increase of $162.0 million from $63.6 million, due to the increase in cash flows generated by operating activities partially offset by an increase in capital expenditures.

Cash and cash equivalents were $457.4 million as of September 30, 2024.

Gross debt

was $2.736 billion as of September 30, 2024.

Other notable highlights from TKO’s investor meeting:

- TKO Group CEO Ariel Emanuel talked about TKO’s recent aqqusations of several companies from Endeavor and them being extremely bullish about the deals and what it brings to their TKO portfolio. Emanuel also praised WWE for their record live event gate in Japan, Bash In Berlin event in Germany, and SummerSlam 2024 becoming the highest grossing non-WrestleMania event in company history.

- Emanuel also stated that WWE’s NXT is up 12% in viewership since moving to The CW.

- Emanuel also praised the strengthening of WWE’s relationship with NBC and USA Network with SmackDown and Saturday Night’s Main Event/

- They stated that WWE’s short term deal with USA Network for their WWE RAW series saw a loss of $50 million for this past fiscal quarter due to the timing.

- On topic of WWE and UFC’s integration, they stated that they are still working to integrate their WWE and UFC companies and also working on building the strategies of having UFC, WWE, and Professional Bull Riding events taking place on the same weekends.

- On the topic of the differences between WWE and UFC’s distribution model for their events, TKO President Mark Shapiro stated that the reason why UFC staying on a PPV model is still the best for them is due to them still selling UFC PPV events internationally while ESPN sells them domestically. Shapiro also stated that the PPV model is still a strong model and will not have a shortage of suitors for new deals regarding this aspect.

- On the topic of how Netflix could increase WWE sponsorship worldwide, Shapiro stated that Netflix were the ones who drove a deal for Minute Maid to come onboard as a new sponsor for WWE and as part of their own sponsorship groups.

- In response to Shapiro’s comments, WWE President Nick Khan responded stating that Netflix has 650 million potential viewers globally. Khan also stated that they are currently expecting even more growth for the company after January 2025 due to Netflix’s global reach.

- On the topic of UFC and WWE cost synergies to date, they stated that they will exceed the upper limit of their savings expectations of $100 million. They also stated that they are currently a little over the upper end expectation as of this past fiscal quarter.

- On the topic of talent departures from WWE and UFC, Shapiro stated that they haven’t had challenges with talent leaving either company due to WWE and UFC being “destination companies” and this being something they do not take for granted.

Sources: PWInsider.com, F4WOnline.com

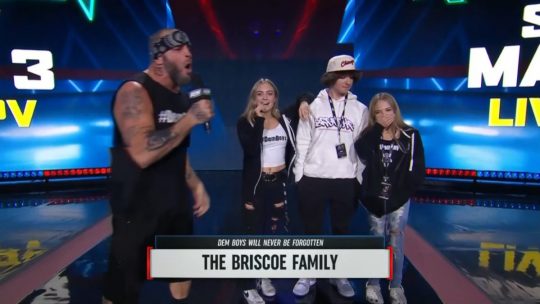

Various: Jay Briscoe’s Daughter Gracie Pugh Shares Recovery Story, Ricky Starks Makes Surprise Appearance at 11/23 GCW Event, Chris Hero’s Mother Passes Away

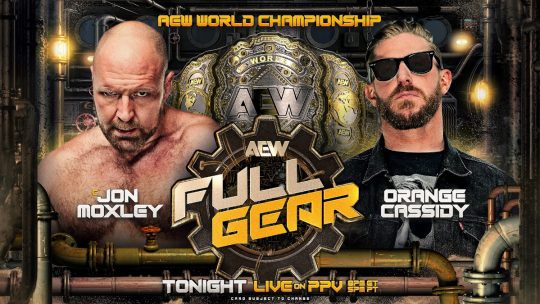

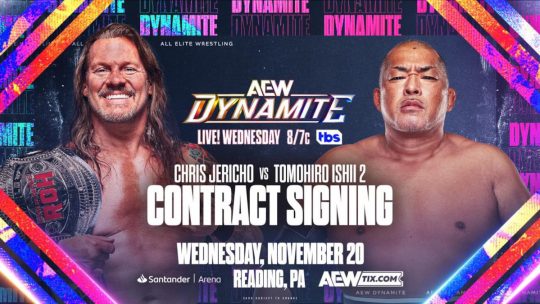

Various: Jay Briscoe’s Daughter Gracie Pugh Shares Recovery Story, Ricky Starks Makes Surprise Appearance at 11/23 GCW Event, Chris Hero’s Mother Passes Away AEW: New Segment Set for 11/20 Dynamite Show, Tony Khan on “I Think Most of the Top Black Wrestlers in the World Are Now in AEW”, Costco Guy AJ Full Gear 2024 Match Plans Update

AEW: New Segment Set for 11/20 Dynamite Show, Tony Khan on “I Think Most of the Top Black Wrestlers in the World Are Now in AEW”, Costco Guy AJ Full Gear 2024 Match Plans Update AEW Dynamite Ratings – Nov. 20, 2024 – Down

AEW Dynamite Ratings – Nov. 20, 2024 – Down