TKO Group held an investor’s meeting on Thursday discussing the results from their fiscal 2024 second quarter report.

In regards to revenues, TKO generated $851.2 million in net revenues for the fiscal quarter with the split being $394.4 million from UFC and $456.8 million from WWE. It was stated that this set a new record for highest second quarter revenue in company history.

TKO generated $150.7 million in net income for the fiscal quarter. It was stated that this increase in revenue was partially offset by an increase in operating expenses, which were stated to be $177 million in direct operating costs, $169.1 million in general and administrative expenses, and $88.8 million in depreciation and amortization.

In regards to other financial areas, TKO’s Adjusted EBITDA for the fiscal quarter was $420.9 million and was stated to be a new quarterly record. WWE’s media rights and content revenue for the fiscal quarter was $260.7 million. WWE’s live events revenue was $144.1 million, sponsorship revenue was $24.7 million, and consumer products revenue was $27.3 million for the fiscal quarter.

TKO Transaction

On September 12, 2023, Endeavor and WWE closed the transaction to combine UFC and WWE to form a new, publicly listed company, TKO Group Holdings, Inc. Reported results presented in this earnings release prior to September 12, 2023 reflect only UFC activity.

Second Quarter 2024 Financial Highlights

Revenue of $851.2 million, a quarterly record

Net income of $150.7 million

Adjusted EBITDA 1 of $420.9 million, a quarterly record

Full Year 2024 Guidance

The Company increased its target for revenue to $2.670 billion to $2.745 billion

The Company increased its target for Adjusted EBITDA to $1.220 billion to $1.240 billion

The Company reaffirmed its target for Free Cash Flow Conversion 2 in excess of 40%

NEW YORK–(BUSINESS WIRE)– TKO Group Holdings, Inc. (“TKO” or the “Company”) (NYSE: TKO) today announced financial results for its second quarter ended June 30, 2024.

“TKO generated strong financial results in the quarter, highlighted by record quarterly revenue and Adjusted EBITDA,” said Ariel Emanuel, Executive Chair and CEO of TKO. “In light of this continued momentum, we are raising our full year 2024 guidance for the second quarter in a row. The strength in our underlying business continues to give us great conviction in TKO’s ability to deliver sustainable long-term value for shareholders.”

Second Quarter Consolidated Results

Revenue increased 179%, or $546.0 million, to $851.2 million. The increase reflected an increase of $89.2 million at UFC, to $394.4 million, and the contribution of $456.8 million of revenue at WWE.

Net Income was $150.7 million, an increase of $68.9 million from $81.8 million in the prior year period. The increase reflected the increase in revenue partially offset by an increase in operating expenses. The increase in operating expenses primarily reflected an increase in direct operating costs of $177.0 million, an increase in selling, general and administrative expenses of $169.1 million, and an increase in depreciation and amortization of $88.8 million.

Adjusted EBITDA 1 increased 142%, or $247.3 million, to $420.9 million, due to an increase of $43.7 million at UFC and the contribution of $251.3 million of Adjusted EBITDA at WWE, partially offset by an increase of $47.7 million in corporate expenses.

Cash flows generated by operating activities were $230.7 million, an increase of $119.7 million from $111.0 million, primarily due to higher net income and the timing of working capital.

Free Cash Flow 2 was $218.6 million, an increase of $112.2 million from $106.4 million, due to the increase in cash flows generated by operating activities partially offset by an increase in capital expenditures, which was primarily related to WWE’s new headquarter facility.

Cash and cash equivalents were $277.5 million as of June 30, 2024.

Gross debt was $2.744 billion as of June 30, 2024.

Other notable highlights from TKO’s investor meeting:

- TKO Group CEO Ari Emanuel stated that TKO has capitalized on the demand for “immersive events” that sports fans want and brought up they had record revenue for the quarter. Emanuel also stated that they have raised their guidance for the year as a result.

- Emanuel also stated that UFC and WWE live events have out-performed their expectations. Emanuel also stated that WWE’s fiscal quarter kicked off with their most successful event ever WrestleMania 40 and followed by their international Backlash 2024 event.

- Emanuel also stated that they have integrated UFC and WWE live events departments.

- Emanuel also stated that they have seen an increasing trend of site origination fees for both WWE and UFC. Emanuel mentioned WWE’s recent deal with Indiana to bring several PPVs there and their new deal with Minnesota as examples.

- TKO CFO Andrew Schleimer said they will continue to integrate the WWE and UFC companies and anticipate further upsides. Schleimer also stated that they have planned for upwards of $150 million in savings with these integrations and current expect at least $100 million in savings so far.

- Schleimer stated that for the fiscal third quarter, there will be less UFC events being held due to the timing of the calendar. Schleimer also stated that they expect WWE to have a healthy growth for that quarter due to the savings they are creating.

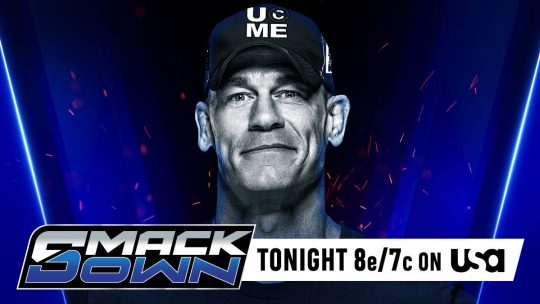

- On the topic of more potential media rights deals, TKO President Mark Shapiro stated that WWE President Nick Khan is currently working on new short-form content deals for WWE. Shapiro stated “The creativity of Paul Levesque on the WWE side. That’s a tall order. He has a Friday night show [SmackDown], a Monday night show [Raw], NXT. We’re talking with other content providers on more short-form content, a bunch of deals that Nick Khan is currently working on and we’ll announce in due time.“

Sources: PWInsider.com, Fightful.com

AEW Collision Ratings – Dec. 6, 2025 – Down

AEW Collision Ratings – Dec. 6, 2025 – Down Ring Boys Scandal Lawsuit Against WWE, TKO, Vince McMahon, & Linda McMahon Update – Lawsuit Allowed to Continue for Most Claims

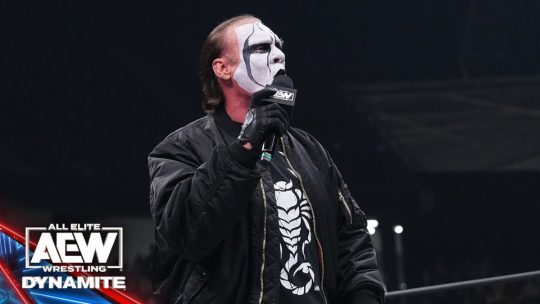

Ring Boys Scandal Lawsuit Against WWE, TKO, Vince McMahon, & Linda McMahon Update – Lawsuit Allowed to Continue for Most Claims Sting on His Run in AEW Felt Like It Was His Own Brand, Tony Khan Treating Him Like Gold, Didn’t Expect to Be In Wrestling for Decades, John Cena’s Retirement, & His Sting Face Paint & Gear Convention Retirement Tour

Sting on His Run in AEW Felt Like It Was His Own Brand, Tony Khan Treating Him Like Gold, Didn’t Expect to Be In Wrestling for Decades, John Cena’s Retirement, & His Sting Face Paint & Gear Convention Retirement Tour