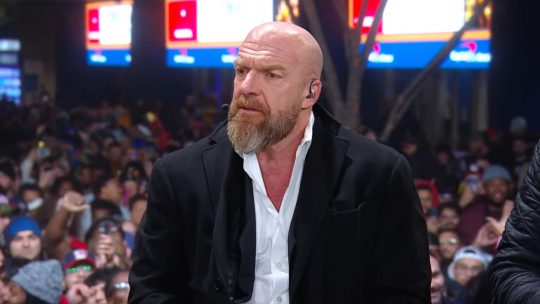

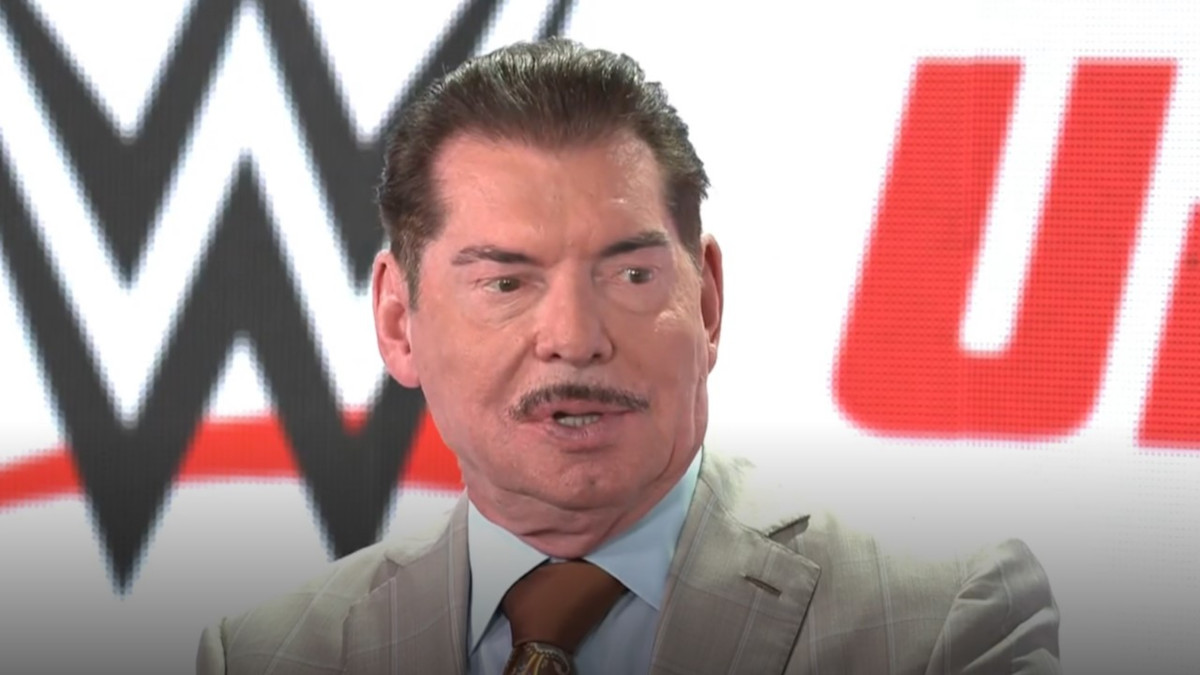

TKO Group Announces Vince McMahon to Sell 8.4 Million Shares of His TKO Stock

TKO Group announced earlier today that Executive Chairman Vince McMahon will be selling 8.4 million shares of his stock in the company.

It was announced that these shares are Class A common stocks and that this will be worth around $100 million.

This amount being sold off is around 30% of McMahon’s total shares in the company, which is around 28 million shares.

TKO Announces Secondary Offering of 8,400,000 Shares of Class A Common Stock by a Selling Stockholder

NEW YORK–(BUSINESS WIRE)– TKO Group Holdings, Inc. (NYSE: TKO) (“TKO” or the “Company”), a premium sports and entertainment company, today announced that one of its stockholders, Mr. Vincent K. McMahon (the “Selling Stockholder”), intends to offer for sale in an underwritten secondary offering 8,400,000 shares of the Company’s Class A common stock, par value $0.00001 (the “Class A Common Stock”), pursuant to the Company’s shelf registration statement filed with the Securities and Exchange Commission (the “SEC”), of which the Company intends to repurchase from the underwriter approximately $100.0 million of shares of our Class A Common Stock. The Selling Stockholder will receive all of the net proceeds from this offering. No shares are being sold by the Company. In connection with the offering, Ariel Emanuel, the Company’s Chief Executive Officer and director, Mark Shapiro, the Company’s President, Chief Operating Officer and director, and certain other of the Company’s directors have indicated an interest in purchasing up to $1.0 million, $1.0 million and $850.0 thousand, respectively, of the Company’s Class A Common Stock offered in the offering at the public offering price.

Morgan Stanley & Co. LLC will act as book-running manager for this offering. MUFG Securities Americas Inc. will act as co-manager for this offering.

A shelf registration statement on Form S-1 (including a prospectus) relating to the offering of Class A Common Stock has been declared effective by the Securities and Exchange Commission. The offering will be made only by means of a prospectus supplement and an accompanying prospectus. You may obtain these documents for free by visiting EDGAR on the SEC website at www.sec.gov. When available, copies of the prospectus supplement and accompanying prospectus related to the offering may also be obtained by contacting Morgan Stanley & Co. LLC, Attn: Prospectus Department, 180 Varick Street, 2nd Floor, New York, NY 10014.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of these securities in any state or other jurisdiction in which such an offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or other jurisdiction.

——————————————

The selling stockholder identified in this prospectus supplement (the “selling stockholder”) is offering 8,400,000 shares of our Class A common stock. We will not receive any proceeds from the sale of our Class A common stock by the selling stockholder.

Subject to the completion of the offering, we intend to purchase from the underwriters approximately $100.0 million of shares of our Class A common stock that are subject to this offering at a price per share equal to the price at which the shares are sold to the public in this offering less the underwriting discounts and commissions set forth on the cover page of this prospectus supplement (the “Share Repurchase”). The repurchased shares of Class A common stock will no longer be outstanding after this offering. We cannot assure you that this offering or the Share Repurchase will be consummated.

Ariel Emanuel, our Chief Executive Officer and director, Mark Shapiro, our President, Chief Operating Officer and director and certain other of our directors have indicated an interest in purchasing up to $1.0 million, $1.0 million and $850.0 thousand, respectively, of our Class A common stock offered in this offering at the public offering price. Because these indications of interest are not a binding agreement or commitment to purchase, they may determine to purchase more, fewer, or no shares in this offering, or the underwriters may determine to sell more, fewer, or no shares to such persons.

Our Class A common stock is listed on the New York Stock Exchange (“NYSE”) under the symbol “TKO.” The last reported sale price of our Class A common stock on the NYSE on November 8, 2023 was $84.60 per share.

We have two classes of common stock outstanding: Class A common stock and Class B common stock. Each share of Class A common stock and Class B common stock entitles its holder to one vote on all matters presented to our stockholders generally. All of our Class B common stock is held by subsidiaries of Endeavor (as defined herein), on a one-to-one basis with the number of TKO OpCo Units (as defined herein) that such subsidiaries of Endeavor own and that were issued to such subsidiaries in exchange for a purchase price equal to the aggregate par value of such shares of Class B common stock.

We are a holding company and our principal assets are the TKO OpCo Units we hold in TKO Operating Company, LLC (“TKO OpCo”), representing approximately 48.2% of TKO OpCo (approximately 47.8% after giving effect to the Share Repurchase). The remaining approximately 51.8% of TKO OpCo (approximately 52.2% after giving effect to the Share Repurchase), is owned by subsidiaries of Endeavor through their ownership of TKO OpCo Units.

As of the date of this prospectus supplement, Endeavor controls more than 50% of our combined voting power for the election of directors on our Board. As a result, we are, and after this offering we will continue to be, considered a “controlled company” for the purposes of NYSE rules and corporate governance standards, and therefore are permitted to, and intend to, elect not to comply with certain corporate governance requirements of the NYSE composed entirely of independent directors. For so long as we remain a “controlled company,” we may at any time and from time to time, utilize any or all of the applicable governance exemptions available under the NYSE rules. Accordingly, holders of Class A common stock do not have the same protections afforded to stockholders of companies that are subject to all of the rules and corporate governance standards of NYSE, and the ability of our independent directors to influence our business policies and affairs may be reduced. See “Risk Factors.”

We currently conduct our business through TKO OpCo and its subsidiaries. TKO Group Holdings manages and operates the business and controls the strategic decisions and day-to-day operations of TKO OpCo and includes the operations of TKO OpCo in its consolidated financial statements.

Ricochet & Fallon Henley Reportedly Suffered Potential Concussion Injuries

Dave Meltzer and Bryan Alvarez reported in a recent episode of the Wrestling Observer Radio that their sources stated that Ricochet and NXT talent Fallon Henley recently suffered potential concussion-based injuries.

In regards to Ricochet, Meltzer reported that WWE officials recently put Ricochet in their concussion protocol following his match at this past Monday’s RAW show that resulted in him suffering a potential concussion injury. This injury reportedly took place following Ricochet landing on his head and neck after a botched springboard hurricanrana to Ivar. Meltzer reported that Ricochet was stated to have felt fine after the match but does not remember much of the match itself.

Melter also reported that it is currently not known when Ricochet will be medically cleared for an in-ring return.

In regards to Henley, Alvarez reported that she suffered a potential concussion injury during her match against Tiffany Stratton at this past Tuesday’s NXT show. Alvarez reported that the currently belief is that Henley suffered the injury following her head bouncing off the mat after Stratton hit her Prettiest Moonsault Ever onto her for the match finish.

Alvarez reported that it is currently not known when Henley will be medically cleared for an in-ring return.

Update on WWE’s Interest in Giulia

As noted before, WWE is currently very interested in potentially signing Stardom talent Giulia to a contract and is rumored to be inviting her to their Performance Center for a tryout as early as some point this month.

Dave Meltzer reported in a recent episode of the Wrestling Observer Radio that his sources stated that WWE officials currently do not have any tryouts planned for Giulia due to her still being under contract with Bushiroad for Stardom until March of 2024. Meltzer reported that Giulia also has a verbal commitment in place with Stardom that extends after her contract’s expiration date.

In regards to WWE’s interest in Giulia, Meltzer reported that this is something that is not new since WWE has been interested in her dating back to 2019. Meltzer reported that Giulia had turned down multiple offers in the past due to not wanting to move to the United States nor being interested in working for the company each time.

In regards to a potential tryout for WWE in the future, Meltzer reported that this can not happen unless Giulia were to get permission from Bushiroad to be able to do so. Giulia reportedly is booked for Stardom throughout the remainder of this year.

WWE Saturday Night’s Main Event Results – Dec. 13, 2025 – John Cena vs. Gunther in John Cena’s Final Match

WWE Saturday Night’s Main Event Results – Dec. 13, 2025 – John Cena vs. Gunther in John Cena’s Final Match AEW Collision Ratings – Dec. 6, 2025 – Down

AEW Collision Ratings – Dec. 6, 2025 – Down WWE: Kendal Grey & Wren Sinclair vs. Fatal Influence Set For 12/16 WWE NXT Show, Nikki Bella on Original Plans for Her WWE Return Run, Stephanie McMahon Reveals She Suffered Miscarriage At One Point, WWE Stars Pay Tribute to John Cena

WWE: Kendal Grey & Wren Sinclair vs. Fatal Influence Set For 12/16 WWE NXT Show, Nikki Bella on Original Plans for Her WWE Return Run, Stephanie McMahon Reveals She Suffered Miscarriage At One Point, WWE Stars Pay Tribute to John Cena