Endeavor, parent company of WWE and TKO Group, announced on Wednesday that they are currently exploring “strategic alternatives” in response to their and TKO Group’s declining stock value issues.

It was announced that this “strategic alternatives” will not include them selling any of their ownership stake in TKO Group.

Endeavor Announces Review of Strategic Alternatives

BEVERLY HILLS, Calif.–(BUSINESS WIRE)–Endeavor Group Holdings, Inc. (NYSE: EDR) (“Endeavor” or the “Company”), a global sports and entertainment company, today announced the initiation of a formal review to evaluate strategic alternatives for the Company.

As part of this review of strategic alternatives, the Company will not consider the sale or disposition of the Company’s interest in TKO Group Holdings, Inc.

“Given the continued dislocation between Endeavor’s public market value and the intrinsic value of Endeavor’s underlying assets, we believe an evaluation of strategic alternatives is a prudent approach to ensure we are maximizing value for our shareholders,” said Ariel Emanuel, CEO of Endeavor.

Endeavor has not set a deadline or definitive timetable for the completion of the strategic alternatives review process, and there can be no assurance that this process will result in any particular outcome. The Company does not intend to comment further regarding the review of strategic alternatives until it determines disclosure is necessary or advisable.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Endeavor intends such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements in this press release that do not relate to matters of historical fact should be considered forward-looking statements, including statements regarding the planned strategic review. The words “believe,” “may,” “will,” “estimate,” “potential,” “continue,” “anticipate,” “intend,” “expect,” “could,” “would,” “project,” “plan,” “target,” and similar expressions are intended to identify forward-looking statements, though not all forward-looking statements use these words or expressions. These forward-looking statements are based on management’s current expectations. These statements are neither promises nor guarantees and involve known and unknown risks, uncertainties and other important factors that may cause actual results, performance or achievements to be materially different from what is expressed or implied by the forward-looking statements, including, but not limited to those factors discussed in Part I, Item 1A “Risk Factors” in Endeavor’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, as any such factors may be updated from time to time in the Company’s other filings with the SEC, including without limitation, the Company’s Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2023, accessible on the SEC’s website at www.sec.gov and Endeavor’s Investor Relations site at investor.endeavorco.com. Forward-looking statements speak only as of the date they are made and, except as may be required under applicable law, Endeavor undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Following Endeavor’s announcement, Endeavor’s majority shareholder Silver Lake announced that they are considering pursing the option of moving Endeavor from its current status as a public company back to being a private company.

Silver Lake Considers Take-Private of Endeavor

MENLO PARK, Calif. & NEW YORK—Silver Lake, the global leader in technology investing, today issued the following statement regarding the disclosure by Endeavor Group Holdings, Inc. (NYSE: EDR) that it is exploring strategic alternatives:

“Silver Lake is committed to strategies that deliver value for all shareholders of Endeavor. To that end, Silver Lake is currently working toward making a proposal to take Endeavor private. Silver Lake firmly believes in Endeavor’s business and is not interested in selling its shares in Endeavor to a third-party nor in entertaining bids for assets that are a part of Endeavor. Silver Lake is the owner of approximately 71% of the voting power of Endeavor. Our Co-Chief Executive Officer, Egon Durban, and our Managing Director, Stephen Evans, serve as members of the Executive Committee of the Board of Directors of Endeavor. Silver Lake has been a committed investor since 2012 and has made significant investments in Endeavor since then to support its growth.”

This press release does not constitute an offer to purchase or a solicitation of an offer to sell any securities of Endeavor. There is no guarantee that Silver Lake will make any proposal or pursue any transaction with respect to Endeavor, and, if any such proposal is made, Silver Lake can provide no assurances that a transaction will be executed or successfully consummated.

Following Endeavor’s announcement, Endeavor’s stock decline by $0.36 ending Wednesday’s trading at $17.72 per share. Following Silver Lake’s announcement, Endeavor’s stocks surged by around 25% and is currently set to open Thursday’s trading at $21.85 per share.

In regards to TKO Group’s stocks, it declined by $1.84 to end Wednesday’s trading at $78.64 per share but also saw a boost in after-hours trading and is currently set to open at $80 per share at the start of Thursday’s trading.

AEW: Bryan Danielson on Being Part of AEW Commentary & Joy It Gives Him, “This Book is All Elite’ Author on Lack of Coverage of CM Punk’s AEW Exit in His Book, “Speedball” Mike Bailey on Not Getting to Wrestle Darby Allin in Continental Classic 2025

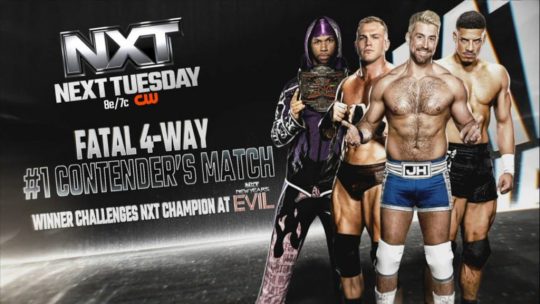

AEW: Bryan Danielson on Being Part of AEW Commentary & Joy It Gives Him, “This Book is All Elite’ Author on Lack of Coverage of CM Punk’s AEW Exit in His Book, “Speedball” Mike Bailey on Not Getting to Wrestle Darby Allin in Continental Classic 2025 WWE NXT Notes: Shiloh Hill Wins NXT In-Ring Debut Match, New NXT Title Match Set for NXT New Year’s Evil 2026, NXT Title #1 Contender Fatal 4-way Match & More Set for 12/16 Show Card

WWE NXT Notes: Shiloh Hill Wins NXT In-Ring Debut Match, New NXT Title Match Set for NXT New Year’s Evil 2026, NXT Title #1 Contender Fatal 4-way Match & More Set for 12/16 Show Card WWE: Kevin Owens & Natalya Reportedly Join As Mentors for WWE LFG Season Three, Sol Ruca on When She Was Told About Match Against Bayley for 12/13 WWE SNME Show, John Cena Confirms Pivots Were Made For Retirement Tour Plans

WWE: Kevin Owens & Natalya Reportedly Join As Mentors for WWE LFG Season Three, Sol Ruca on When She Was Told About Match Against Bayley for 12/13 WWE SNME Show, John Cena Confirms Pivots Were Made For Retirement Tour Plans