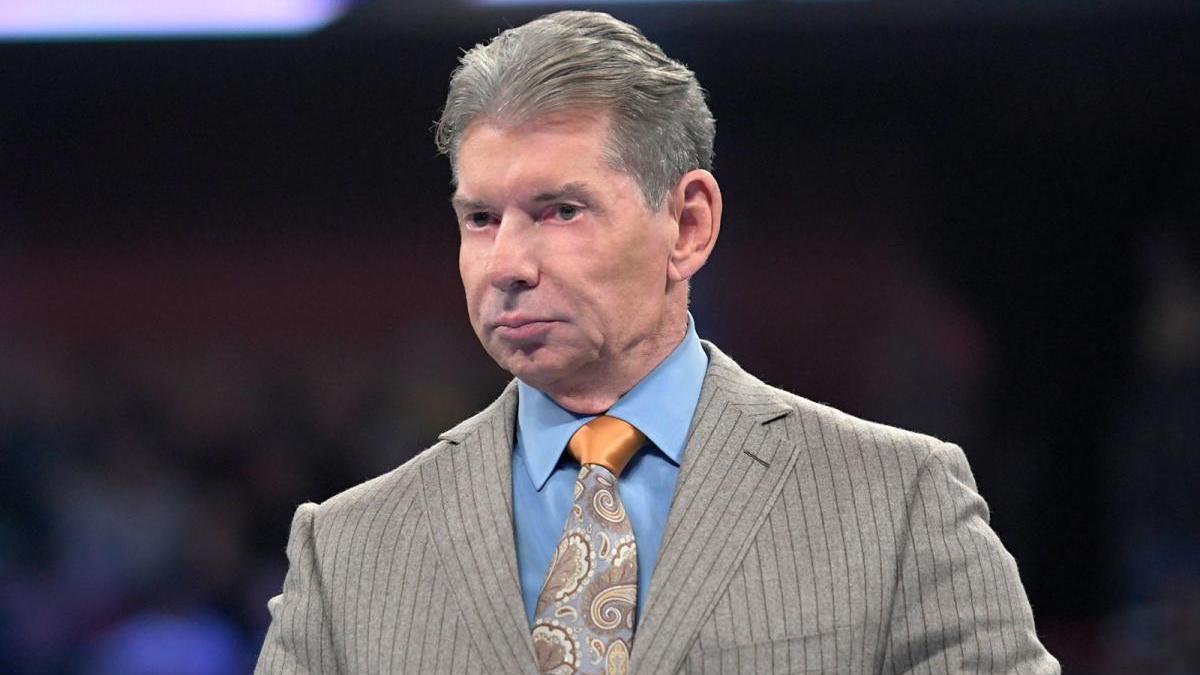

As noted before, WWE announced this past Friday that Vince McMahon has officially returned to the company and will be resuming his role as the Executive Chairman of their Board of Directors. As part of the fallout of McMahon’s recent return, six members of WWE’s Board of Directors have either been replaced or resigned with the latest being now former WWE co-CEO Stephanie McMahon.

Bloomberg Law reported that a class action lawsuit against Vince McMahon was filed by a WWE shareholder, Scott Fellows, on Tuesday in the Chancery Court of Delaware. Fellows’ lawsuit is claiming that McMahon had breached his Fiduciary Duty as WWE’s Controlling Stockholder over his return to the company and resuming his role as Executive Chairman of WWE’s Board of Directors.

This lawsuit also is alleging that McMahon used his controlling shares of WWE’s voting power to oust three members of WWE’s Board and replace them with his own hand-pick people. McMahon is also alleged to have used his voting power to purposely change WWE’s bylaws to facilitate his return and prevent the company from going ahead with any media rights deals or sale without his explicit approval on their Board.

Portions of Fellows’ class action lawsuit:

Following an investigation into allegations of sexual harassment against McMahon, the Board unanimously determined it was not in the best interests of the Company and its stockholders for McMahon to return to WWE. Nonetheless, McMahon executed the Written Consent to remove certain directors who opposed him and add himself and two cronies to the Board. The Stockholder Approval Amendment went further and usurped the power of the Board to manage the affairs of the Company. It even prohibits the Board and officers from advocating for transactions McMahon may oppose even if they believe those transactions are in the best interests of the Company and its stockholders.

As such, McMahon violated his fiduciary duties by executing the Written Consent.

Plaintiff is entitled to a declaration that the Stockholder Approval Amendment is void and invalid. Plaintiff has no adequate remedy at law.

The Stockholder Approval Amendment violates Section 141 of the DGCL and WWE’s Charter, which vests management of the Company with WWE’s Board. The Stockholder Approval Amendment was also adopted for the inequitable purpose of holding the Board and management hostage with respect to virtually every major strategic decision.

The Stockholder Approval Amendment prevents the Board or management from, directly or indirectly, authorizing, agreeing to, permitting, endorsing, recommending, approving, or effecting a new media rights agreement, a significant stock issuance, or an agreement that deters replacing directors without the prior approval of stockholders, i.e., McMahon.

In his filing, Fellows is asking the court for his lawsuit to be approved as a class action lawsuit so that other WWE shareholders who have been affected can join. Fellows is also asking for an official court declaration that McMahon had breached his fidiciary duties and that the recent Stockholder Approval Amendment is invalid due to his claims that it violated WWE’s charter.

Fellows is currently asking to be awarded damages covering the cost of his lawsuit, including his attorney, accountant, and expert witness fees.

AEW: Adam Copeland Will Ospreay Thanks Fans for How Much They’ve Helped Him Grow as a Wrestler & Man, New Matches and Segment Set for 12/21 Christmas Collision Show

AEW: Adam Copeland Will Ospreay Thanks Fans for How Much They’ve Helped Him Grow as a Wrestler & Man, New Matches and Segment Set for 12/21 Christmas Collision Show WWE: Kevin Owens on His Attack on Cody Rhodes on 12/14 SNME Show, Jim Smallman Announces Departure from WWE NXT Creative Team, More on NXT Dec. 17, 2024 Viewership

WWE: Kevin Owens on His Attack on Cody Rhodes on 12/14 SNME Show, Jim Smallman Announces Departure from WWE NXT Creative Team, More on NXT Dec. 17, 2024 Viewership Five Continental Classic Matches Set for 12/25 AEW Dynamite on 34th St Show

Five Continental Classic Matches Set for 12/25 AEW Dynamite on 34th St Show