WWE released their financial report for the third quarter of 2018 today.

In response, WWE’s stock price dropped over 4% as of 1:30 PM ET.

Here’s a general breakdown of their revenue:

The report also said that WWE Network paid subscribers grew 9% in the quarter to an average of 1.66 million.

Here’s the press release and you can view the full report here.

Third Quarter 2018 Highlights

- Revenues reached $188.4 million for the third quarter 2018 and a record $657.7 million for the nine months ended September 30, 2018, representing 12% growth over the prior year period

- Operating income was $18.1 million. Adjusted OIBDA of $35.8 million exceeded the Company’s guidance

- Through the first nine months of 2018, digital engagement increased with video views up 61% to 22.9 billion and hours consumed up 81% to 842 million across digital and social media platforms

2018 Business Outlook

- Full year 2018 Adjusted OIBDA is expected to range from $160 million to $170 million, which would be consistent with the Company’s previous guidance

- WWE has operated in the Middle East for nearly 20 years and has developed a sizable and dedicated fan base. Considering the heinous crime committed at the Saudi consulate in Istanbul, the Company faced a very difficult decision as it relates to its event scheduled for November 2 in Riyadh. Similar to other U.S.-based companies who plan to continue operations in Saudi Arabia, the Company has decided to uphold its contractual obligations to the General Sports Authority and stage the event. Full year 2018 guidance is predicated on the staging of the Riyadh event as scheduled

STAMFORD, Conn., October 25, 2018 – WWE (NYSE: WWE) today announced financial results for its third quarter ended September 30, 2018.

“During the quarter, we remained keenly focused on deepening engagement with our global fan base by delivering compelling original content across media platforms,” said Vince McMahon, WWE Chairman and Chief Executive Officer. “We believe that deepening engagement will enable us to take advantage of favorable global industry trends and drive long-term growth.”

George Barrios, Co-President, added “We continue to effectively execute our strategy and achieved Adjusted OIBDA that surpassed our public guidance. Our performance maintains our path to achieve record revenue, record Adjusted OIBDA and record subscribers for the full year 2018.”

Third-Quarter Consolidated Results

Revenues of $188.4 million increased slightly from the third quarter 2017, as the increased monetization of content as reflected in the Media segment was nearly offset by lower ticket sales at the Company’s live events and a $2.6 million unfavorable impact on licensing revenue due to the adoption of the new FASB standard for revenue recognition (ASC Topic 606).

Operating Income decreased to $18.1 million from $33.9 million in the prior year quarter, reflecting the slight increase in revenue, which was more than offset by increased operating expenses, including increases in fixed costs, the timing of various business initiatives, and higher management incentive compensation based on anticipated strong full-year results as well as the rise in the Company’s stock price. The Company’s Operating income margin was 10% as compared to 18% in the prior year quarter.

Adjusted OIBDA (which excludes stock compensation) was $35.8 million as compared to $45.6 million in the prior year quarter. The Company’s Adjusted OIBDA margin decreased to 19% from 24%.

Net Income was $33.6 million, or $0.37 per diluted share, as compared to $21.8 million, or $0.28 per diluted share, in the prior year quarter.

Effective Tax Rate was (87%) as compared to 30% in the prior year quarter driven by the recognition of $20.7 million of excess tax benefits related to the Company’s share-based compensation awards at vesting, as compared to $1.6 million in the prior year quarter. Excluding this discrete tax item, our effective tax rate was 28% in the current year quarter as compared to 35% in the prior year quarter. The tax benefit recorded during the current year is driven by the increase in the Company’s stock price between the original grant date of the awards and their subsequent vesting date in the third quarter of 2018. Further impacting the decline in the effective tax rate was the reduction of the federal corporate income tax rate as a result of the Tax Cuts and Jobs Act of 2017 (the “Tax Act”), which was enacted on December 22, 2017.

Cash flows generated by operating activities reached $44.7 million and Free Cash Flow totaled $35.5 million as compared to $27.2 million and $22.0 million, respectively, in the prior year quarter.5 The growth in both measures was primarily due to the favorable timing of working capital.

Year-to-date 2018 Consolidated Results

For the nine months ended September 30, 2018, revenues increased 12% to $657.7 million from $589.4 million. Operating income increased 26% to $61.1 million from $48.6 million, and Adjusted OIBDA increased 20% to $114.5 million from $95.1 million. Net income increased 110% to $58.4 million ($0.66 per diluted share) from $27.8 million ($0.36 per diluted share) in the prior year period.

Cash flows generated by operating activities reached $121.5 million and Free Cash Flow totaled $100.1 million as compared to $41.0 million and $23.3 million, respectively, in the prior year period.5 The growth in both measures was primarily due to improved operating performance and favorable timing of working capital.

Cash, cash equivalents and short-term investments were approximately $316 million as of September 30, 2018, and the Company estimates debt capacity under its revolving line of credit of approximately $100 million.

WWE: Ethan Page on Matt Hardy Had “100% Given & Endorsed” Him to Use Twisted Grin (Twist of Fate) Finisher, A&E WWE Ratings for March 9, 2025, More News

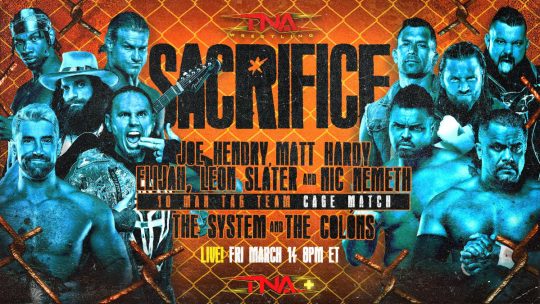

WWE: Ethan Page on Matt Hardy Had “100% Given & Endorsed” Him to Use Twisted Grin (Twist of Fate) Finisher, A&E WWE Ratings for March 9, 2025, More News MLP Mayhem Night 1 Results – March 14, 2025 – Thom Latimer vs. Bishop Dyer

MLP Mayhem Night 1 Results – March 14, 2025 – Thom Latimer vs. Bishop Dyer AEW International Title Eliminator Tournament Announced & Kicking Off on 3/12 AEW Dynamite Show

AEW International Title Eliminator Tournament Announced & Kicking Off on 3/12 AEW Dynamite Show