WWE sent out the following today….

STAMFORD, Conn.–(BUSINESS WIRE)–World Wrestling Entertainment, Inc. today announced financial results for its first quarter ended March 31, 2010. Revenues totaled $138.7 million as compared to $107.8 million in the prior year quarter. Operating income was $37.3 million as compared to $16.7 million in the prior year quarter. Net income was $24.7 million, or $0.33 per share, as compared to $10.3 million, or $0.14 per share in the prior year quarter. There are several items that impact comparability, primarily the timing of WrestleMania® XXVI. Excluding these items, revenues totaled $109.9 million, adjusted operating income was $22.6 million and adjusted net income was $14.7 million, or $0.20 per share.

“In the first quarter, we delivered significant growth in earnings and profitability, reaching our highest operating margin in our recent history,” stated Vince McMahon, Chairman and Chief Executive Officer. “WrestleMania XXVI attracted more than 70,000 fans and contributed profits of over $13 million for the second consecutive year. Looking ahead, our faith in the future is strengthened by the ongoing power of our brands, the strength of our partnerships and our ongoing focus on operating efficiency. We remain confident that we can achieve our targeted earnings growth and drive greater profits.” As previously communicated, the WWE business outlook targets average annual earnings growth of 15% to 20% over the 2009-2012 period.

Comparability of Results

WrestleMania XXVI occurred on March 28, 2010, and consequently, is included in our first fiscal quarter financial results. However, WrestleMania XXV occurred on April 5, 2009 and was included as part of our second quarter results in 2009. WrestleMania XXVI contributed approximately $28.8 million of revenues, $13.1 million of profit contribution ($8.8 million, net of tax) and $0.12 of EPS from across our various business lines in the current quarter. The Q1 2010 results also reflect an infrastructure tax credit which reduced depreciation and amortization expense by $1.6 million. In addition, Q1 2009 results included approximately $2.2 million of restructuring related expenses associated with our headcount reduction that occurred in January 2009. For comparative purposes, schedules showing the Adjusted Operating Income, Adjusted EBITDA and Adjusted Net Income, excluding the impact of WrestleMania XXVI and these items, have been provided in the supplemental information included in this release.

Results by Business Segment

Revenues from North America and outside North America increased 28% and 33%, respectively, led by our Live and Televised Entertainment segment. Excluding the impact of WrestleMania XXVI, revenues from North America decreased 3% and outside North America increased 19%. In addition, there was an approximate $2.1 million favorable impact from foreign exchange rates.

Venue Merchandise revenues were $6.5 million as compared to $4.6 million in the prior year quarter. The increase is due to higher per capita sales of $10.33 in the current quarter as compared to $9.29 in the prior year quarter. Excluding the impact of WrestleMania XXVI, revenues were $4.9 million and per capita sales was $8.41 in the current quarter.

Television Rights Fees revenues were $29.4 million as compared to $24.9 million in the prior year quarter. This increase was primarily due to license fees received from our new WWE Superstars television show and contractual increases from our existing programs.

WWE Classics on Demand™ revenues were $1.3 million as compared to $1.5 million in the prior year quarter, primarily due to a decline in domestic subscribers.

Consumer Products

Revenues from our Consumer Products businesses were $30.7 million versus $33.1 million in the prior year quarter. Consumer Products revenues declined 7% primarily due to a decline in our Home Video business.

Home Video net revenues were $7.6 million as compared to $9.2 million in the prior year quarter. This decrease reflects a reduction in the sale of new releases as shipments declined 11% to approximately 813,000 units in the current period. In addition, revenues were negatively impacted by a 6% decline in average price per unit to approximately $13.75 and lower sell-through rates.

Licensing revenues were $19.9 million as compared to $19.8 million in the prior year quarter, reflecting additional sales of toys and novelties partially offset by lower video game sales. Toys and novelties increased by approximately $0.5 million and $0.6 million, respectively, while revenues related to video games declined by $1.0 million in the current quarter.

Magazine publishing net revenues were $2.8 million as compared to $3.5 million in the prior year quarter, primarily reflecting lower sell-through rates in the current quarter.

Digital Media

Revenues from our Digital Media related businesses were $6.4 million as compared to $6.9 million in the prior year, representing a 7% decrease.

WWE.com revenues were $3.4 million as compared to $3.9 million in the prior year quarter, primarily reflecting a decline in wireless and online advertising revenues.

WWEShop revenues were $3.0 million in both the current and prior year quarter. The number of orders increased by 3% to approximately 62,000 which was offset by a 4% decline in the average revenue per order to $47.77 as compared to the prior year quarter.

WWE Studios

During the current quarter, we recorded revenue of $3.4 million related to previously released films as compared to $3.7 million in the prior year quarter. We participate in revenues generated by the distribution of these films after the print, advertising and distribution costs incurred by our distributors have been recouped and the results have been reported to us. Accordingly, we have not recorded revenues for 12 Rounds or The Marine 2.

Profit Contribution (Net revenues less cost of revenues)

Profit contribution increased to $65.0 million in the current quarter as compared to $51.4 million in the prior year quarter, reflecting approximately $13.1 million in WrestleMania XXVI related profit in the current quarter. Gross profit contribution margin remained essentially unchanged at approximately 47% as compared to 48% in the prior year quarter, reflecting efficiencies in our Live and Televised Entertainment segment offset by a decline in our Consumer Products segment. The efficiencies in the Live and Televised Entertainment segment were led by sustained cost reductions in marketing and TV production. The decline in the Consumer Products segment was primarily due to decreases in our Home Video business. Excluding the impact of WrestleMania XXVI in the current quarter, profit was essentially flat as compared to the prior year quarter and contribution margin was 47%.

Selling, general and administrative expenses

SG&A expenses were $25.8 million for the current quarter as compared to $30.9 million in the prior year quarter, reflecting decreases in staff related expenses, legal and professional fees and bad debt expense. Excluding items that impact comparability, SG&A expenses declined 10% to $25.8 million in the current quarter from $28.7 million in the prior year quarter.

Depreciation and amortization

Depreciation and amortization expense was $1.9 million for the current quarter as compared to $3.8 million in the prior year quarter, reflecting a $1.6 million benefit from the recognition of an infrastructure tax credit received in the current quarter. Excluding items that impact comparability, depreciation and amortization expense was $3.5 million in the current quarter as compared to $3.8 million in the prior year quarter.

EBITDA

EBITDA was approximately $39.2 million in the current quarter as compared to $20.5 million in the prior year quarter. Excluding the impact of items affecting comparability, adjusted EBITDA was $26.1 million as compared to $22.8 million in the prior year quarter.

Investment and Other (Expense) Income

The decline in investment income of $0.1 million in the current quarter reflects lower interest rates. Other expense of $1.0 million, as compared to other expense of $1.3 million in the prior year quarter, reflects changes in the revaluation of warrants held in certain licensees, partially offset by increased foreign exchange losses.

Effective tax rate

In the current quarter, the effective tax rate was 33% as compared to 35% in the prior year quarter. The decrease in tax rate year over year was primarily driven by increased benefits from Internal Revenue Code (IRC) Section 199 related to qualified domestic production activities.

Cash Flows

Net cash provided by operating activities was $38.0 million for the three months ended March 31, 2010 as compared to $47.3 million in the prior year period. This decrease was driven by the timing of WrestleMania XXVI, feature film investments and changes in working capital, including changes in the Company’s tax position.

Additional Information

Additional business metrics are made available to investors on a monthly basis on our corporate website – corporate.wwe.com. Note: World Wrestling Entertainment, Inc. will host a conference call on May 6, 2010 at 11:00 a.m. ET to discuss the Company’s earnings results for the first quarter of 2010. All interested parties can access the conference call by dialing 888-647-2706 (conference ID: WWE). Please reserve a line 15 minutes prior to the start time of the conference call. A presentation that will be referenced during the call can be found at the Company web site at corporate.wwe.com. A replay of the call will be available approximately three hours after the conference call concludes, and can be accessed at corporate.wwe.com.

World Wrestling Entertainment, Inc., a publicly traded company ( NYSE : WWE – News), is an integrated media organization and recognized leader in global entertainment. The company consists of a portfolio of businesses that create and deliver original content 52 weeks a year to a global audience. WWE is committed to family-friendly, PG content across all of its platforms including television programming, pay-per-view, digital media and publishing. WWE programming is broadcast in more than 145 countries and 30 languages and reaches more than 500 million homes worldwide. The Company is headquartered in Stamford, Conn., with offices in New York, Los Angeles, Chicago, London, Shanghai, Tokyo and Toronto.

Trademarks: All WWE programming, talent names, images, likenesses, slogans, wrestling moves, trademarks, copyrights and logos are the exclusive property of World Wrestling Entertainment, Inc. and its subsidiaries. All other trademarks, logos and copyrights are the property of their respective owners.

Forward-Looking Statements: This news release contains forward-looking statements pursuant to the safe harbor provisions of the Securities Litigation Reform Act of 1995, which are subject to various risks and uncertainties. These risks and uncertainties include risks relating to maintaining and renewing key agreements, including television distribution agreements; the need for continually developing creative and entertaining programming; the continued importance of key performers and the services of Vincent McMahon; the conditions of the markets in which we compete; acceptance of the Company’s brands, media and merchandise within those markets; uncertainties relating to regulatory and litigation matters; risks resulting from the highly competitive nature of our markets; the importance of protecting our intellectual property and complying with the intellectual property rights of others; risks associated with producing live events both domestically and internationally; uncertainties associated with international markets; risks relating to our film business and any new business initiative which we may undertake; risks relating to the large number of shares of common stock controlled by members of the McMahon family; and other risks and factors set forth from time to time in Company filings with the Securities

and Exchange Commission. Actual results could differ materially from those currently expected or anticipated. In addition, our dividend is significant and is dependent on a number of factors, including, among other things, our liquidity and historical and projected cash flow, strategic plan (including alternative uses of capital), our financial results and condition, contractual and legal restrictions on the payment of dividends, general economic and competitive conditions and such other factors as our Board of Directors may consider relevant, including a waiver by the McMahon family of a portion of the dividends.

Non-GAAP Measure:

We define Adjusted Operating Income, Adjusted EBITDA and Adjusted Net Income as Operating Income, EBITDA and Net Income adjusted for significant non-recurring events that affect comparability. The schedule above adjusts for a one-time restructuring charge, the timing difference of WrestleMania and a non-recurring infrastructure tax credit. Although these metrics are not recognized measures of performance under U.S. GAAP, Adjusted Operating Income and Adjusted EBITDA are presented for comparative purposes of the Company’s normalized performance. Adjusted Operating Income and Adjusted EBITDA should not be considered as an alternative to net income, cash flows from operations or any other indicator of World Wrestling Entertainment Inc.’s performance or liquidity, determined in accordance with U.S. GAAP.

Supplemental Information:

Net income per share of Class A Common Stock and Class B Common Stock is computed in accordance with a two-class method of earnings allocation. Any undistributed earnings for each period are allocated to each class of common stock based on the proportionate share of the amount of cash dividends that each class is entitled to receive. There were no undistributed earnings for the three months ended March 31, 2009.

EBITDA is defined as net income before investment, interest and other expense/income, income taxes, depreciation and amortization. The Company’s definition of EBITDA does not adjust its U.S. GAAP basis earnings for the amortization of Feature Film production assets. Although it is not a recognized measure of performance under U.S. GAAP, EBITDA is presented because it is a widely accepted financial indicator of a company’s performance. The Company uses EBITDA to measure its own performance and to set goals for operating managers. EBITDA should not be considered as an alternative to net income, cash flows from operations or any other indicator of World Wrestling Entertainment Inc.’s performance or liquidity, determined in accordance with U.S. GAAP.

We define Free Cash Flow as net cash provided by operating activities less cash used for capital expenditures. Although it is not a recognized measure of liquidity under U.S. GAAP, Free Cash Flow provides useful information regarding the amount of cash our continuing business is generating after capital expenditures, available for reinvesting in the business and for payment of dividends.

AEW Full Gear 2024 Post-Show Media Scrum: Big Boom AJ on Potential AEW Return, Daniel Garcia on TNT Title Win, WWE ID’s Impact on Indies, Jon Moxley’s Importance to AEW, Ricky Starks & Kenny Omega Abscesses, Adam Copeland Injury Update

AEW Full Gear 2024 Post-Show Media Scrum: Big Boom AJ on Potential AEW Return, Daniel Garcia on TNT Title Win, WWE ID’s Impact on Indies, Jon Moxley’s Importance to AEW, Ricky Starks & Kenny Omega Abscesses, Adam Copeland Injury Update Kylie Rae Announced as Newest WWE ID Signee at Thursday Freelance Wrestling Event

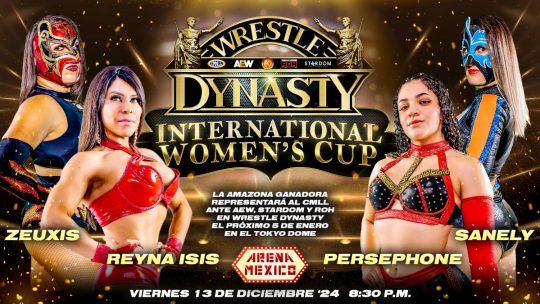

Kylie Rae Announced as Newest WWE ID Signee at Thursday Freelance Wrestling Event Various: CMLL Qualifier Match Set for International Women’s Cup at Wrestle Dynasty, WWE ID Showcase Match Set for WWN Event, Nikki Garcia & Artem Chigvintsev Agree to Divorce Settlement

Various: CMLL Qualifier Match Set for International Women’s Cup at Wrestle Dynasty, WWE ID Showcase Match Set for WWN Event, Nikki Garcia & Artem Chigvintsev Agree to Divorce Settlement