Representatives for Hulk Hogan issued the following announcement today…

FOR IMMEDIATE RELEASE

Hulk Hogan files lawsuit against Wells Fargo Insurance Services

Southeast Inc. and Wells Fargo Insurance Services USA, Inc.

Earlier today Terry Bollea a/k/a Hulk Hogan filed a lawsuit in Pinellas County, Florida Circuit Court against Wells Fargo Insurance Services Southeast and Wells Fargo Insurance Services USA. A summary of the allegations contained in the suit are summarized below:

Wells Fargo is an insurance broker in the business of, among other things, providing asset protection insurance for high net worth individuals. For many years up to and including August 26, 2007, Wells Fargo brokered a large range of insurance coverages for the Bollea family, cumulatively receiving tens of thousands of dollars in brokerage fees to do so.

Wells Fargo owed Hogan a fiduciary duty under Florida law to act in his best interests in regard to adequately protecting his assets in the event of a potential third party liability claim against him.

On August 26, 2007, Hogan’s minor son, Nick, while driving a vehicle owned by Hogan was involved in an automobile accident which resulted in serious injuries to his passenger, John Graziano. In March 2008, representatives of Graziano brought suit against Hogan seeking to hold him individually and vicariously liable for injuries Graziano sustained in the collision. At the time of the accident Hogan was woefully underinsured for third party losses sustained by drivers of vehicles he owned, having primary automobile liability limits of only $250,000, per person injured. Hogan had no excess umbrella coverage available to protect his hard-earned assets despite an estimated net worth exceeding $30 million and a multi-million dollar annual income.

The Defendant, Wells Fargo, breached its fiduciary duties to Hogan under Florida law by failing entirely to inform, counsel and advise him of the need for excess risk coverage and the inadequacy of his insurance protection, particularly in light of Wells Fargo’s knowledge that Hogan had teenage drivers in his household for which he was legally responsible.

On April 20, 2010, Hogan, to resolve liability claims filed against him, paid representatives of Graziano a confidential settlement amount in excess of Hogan’s available automobile liability coverage. This uninsured loss to Hogan was as a direct result of the breached fiduciary duties owed to him by Wells Fargo. The lawsuit filed today seeks recovery in full from the Defendants for all sums Hogan was unnecessarily required to pay as a result of the Defendants’ negligence.

TOP NEWS POST NOW: WWE NXT Diva Savannah TOPLESS – You *MUST* Be 18+ To View Now!!

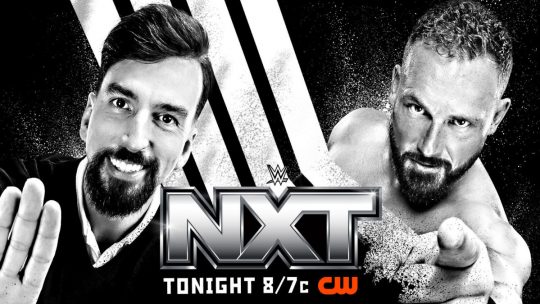

Various: Diamond Dallas Page on Not Having Time for Another Match, TNA Bound For Glory PPV Buys Update, Jake Paul Defeats Mike Tyson, Indies

Various: Diamond Dallas Page on Not Having Time for Another Match, TNA Bound For Glory PPV Buys Update, Jake Paul Defeats Mike Tyson, Indies AZM vs. Mayu Iwatani for IWGP Women’s Title Set for NJPW Wrestle Kingdom 19

AZM vs. Mayu Iwatani for IWGP Women’s Title Set for NJPW Wrestle Kingdom 19 CMLL Announces PAC, “Timeless” Toni Storm, Claudio Castagnoli, & Red Velvet for 12/13 Super Viernes Event

CMLL Announces PAC, “Timeless” Toni Storm, Claudio Castagnoli, & Red Velvet for 12/13 Super Viernes Event